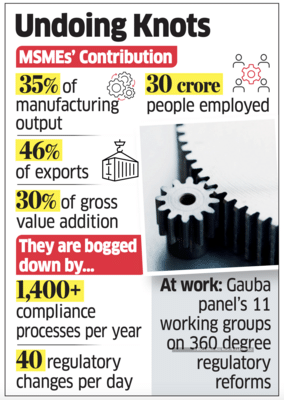

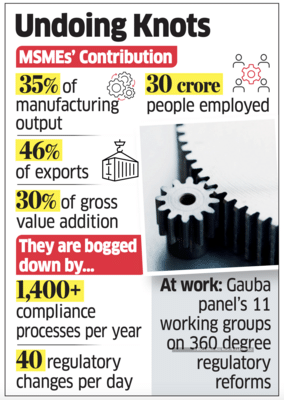

New Delhi: The panel established to draw up India’s reform agenda has begun by recommending 38 time-bound measures in four key focus areas. These include steps to free up the micro, small and medium enterprises (MSME) sector, which it says is “disproportionately constrained by complex regulations and compliances,” ET has learnt.

The three other segments are environmental regulations, the Food Safety and Standards Authority of India ( FSSAI) and the Bureau of Indian Standards (BIS).

The panel urged scrapping mandatory corporate social responsibility (CSR) requirements and penalty reductions for MSMEs. It also suggested doing away with the “licence and inspection raj” of FSSAI, besides rationalising the complex regime of multiple BIS standards to a simple twin-scheme one.

Even a small MSME unit is bogged down by over 1,400 compliances annually and needs to track over 40 regulatory changes per day, said the high-level committee on non-financial regulations, led by Niti Aayog member Rajiv Gauba, that was set up after PM Narendra Modi’s big reform call on Independence Day.

Recommendations for FSSAI, BIS

Aiming for a more modern “trust-based” regulatory framework, the committee is making its first recommendations to deregulate and reduce the compliance burden.

ET reported the big deregulation moves on environment on October 20. The following is a list of the recommendations by the committee on the other three areas.

MSMEs: Definitions, Disputes, Credit flow

By November 30: Revise the definition of ‘small company’ to sync with the MSME Development Act, 2006, to include all enterprises with a turnover of ₹100 crore (up from ₹40 crore) and paid-up capital of ₹10 crore (up from ₹4 crore) under its ambit.

By December 31: Exempt MSMEs from all mandatory CSR requirements (at least 2% of average net profit over previous three years) and other CSR-linked regulatory obligations. Amendment to Section 135 of the Companies Act, 2013, needed.

By December 31: Reduce board meeting requirements for small companies from two per year to one. Instead of annual director filings, only event-based ones. No mandatory auditor for small companies with turnover of less than ₹1 crore. Amendments required in laws.

By October 31: Reduce high penal interest from 18% to 12% for delayed tax payment by short-staffed micro enterprises. Lower harsh penalties for minor errors to maximum of ₹5,000 instead of ₹25,000.

By December 31: GST returns simplification includes requiring annual filing instead of quarterly for all micro enterprises with turnover up to ₹10 crore, and quarterly returns instead of monthly for small enterprises of turnover over ₹100 crore.

By March 31, 2026: For those dealing in goods, increase the GST exemption limit from current Rs 40 lakh to ₹1 crore; for others, raise it from ₹20 lakh to ₹50 lakh.

By October 31: Boosting ecommerce exports suggested, with DPIIT clarifying and easing 100% FDI rules (Press Note 2) for ecommerce exports to not be treated as part of inventory-based prohibited category.

By December 31: Amend MSME laws to introduce sole mediator and sole arbitrator for faster resolution of payment disputes. Launch online adjudication process, expand MSME facilitation councils, mandate pre-deposit enforcement through actual deposits and 50% release of payments that are held up.

By November 30: Expand credit guarantee trust for micro and small enterprises to medium enterprises as well with a separate corpus. Increase maximum guarantee threshold from ₹10 crore to ₹50 crore per borrower.

By March 31, 2026: Increase threshold for tax audit from ₹1 crore to ₹2 crore—for micro entities with over 5% cash receipts.

The three other segments are environmental regulations, the Food Safety and Standards Authority of India ( FSSAI) and the Bureau of Indian Standards (BIS).

The panel urged scrapping mandatory corporate social responsibility (CSR) requirements and penalty reductions for MSMEs. It also suggested doing away with the “licence and inspection raj” of FSSAI, besides rationalising the complex regime of multiple BIS standards to a simple twin-scheme one.

Even a small MSME unit is bogged down by over 1,400 compliances annually and needs to track over 40 regulatory changes per day, said the high-level committee on non-financial regulations, led by Niti Aayog member Rajiv Gauba, that was set up after PM Narendra Modi’s big reform call on Independence Day.

Recommendations for FSSAI, BIS

Aiming for a more modern “trust-based” regulatory framework, the committee is making its first recommendations to deregulate and reduce the compliance burden.

ET reported the big deregulation moves on environment on October 20. The following is a list of the recommendations by the committee on the other three areas.

MSMEs: Definitions, Disputes, Credit flow

By November 30: Revise the definition of ‘small company’ to sync with the MSME Development Act, 2006, to include all enterprises with a turnover of ₹100 crore (up from ₹40 crore) and paid-up capital of ₹10 crore (up from ₹4 crore) under its ambit.

By December 31: Exempt MSMEs from all mandatory CSR requirements (at least 2% of average net profit over previous three years) and other CSR-linked regulatory obligations. Amendment to Section 135 of the Companies Act, 2013, needed.

By December 31: Reduce board meeting requirements for small companies from two per year to one. Instead of annual director filings, only event-based ones. No mandatory auditor for small companies with turnover of less than ₹1 crore. Amendments required in laws.

By October 31: Reduce high penal interest from 18% to 12% for delayed tax payment by short-staffed micro enterprises. Lower harsh penalties for minor errors to maximum of ₹5,000 instead of ₹25,000.

By December 31: GST returns simplification includes requiring annual filing instead of quarterly for all micro enterprises with turnover up to ₹10 crore, and quarterly returns instead of monthly for small enterprises of turnover over ₹100 crore.

By March 31, 2026: For those dealing in goods, increase the GST exemption limit from current Rs 40 lakh to ₹1 crore; for others, raise it from ₹20 lakh to ₹50 lakh.

By October 31: Boosting ecommerce exports suggested, with DPIIT clarifying and easing 100% FDI rules (Press Note 2) for ecommerce exports to not be treated as part of inventory-based prohibited category.

By December 31: Amend MSME laws to introduce sole mediator and sole arbitrator for faster resolution of payment disputes. Launch online adjudication process, expand MSME facilitation councils, mandate pre-deposit enforcement through actual deposits and 50% release of payments that are held up.

By November 30: Expand credit guarantee trust for micro and small enterprises to medium enterprises as well with a separate corpus. Increase maximum guarantee threshold from ₹10 crore to ₹50 crore per borrower.

By March 31, 2026: Increase threshold for tax audit from ₹1 crore to ₹2 crore—for micro entities with over 5% cash receipts.

You may also like

Is the world going to end? NASA supercomputer warns Earth could become lifeless soon

IRA in the making: Ghazwa-e-Hind rhetoric, 8,850 trainees at seven camps in Bangladesh

Zhao Xintong breaks silence on health issue that left snooker world champ 'unable to see'

"Reality is NDA will form govt on November 14," says Chirag Paswan, calls Mahagathbandhan 'non-serious'

M60 traffic LIVE: Huge delays on motorway after horror crash