Economies around the world aren’t currently enduring the best of times, thanks to US President Donald Trump, who announced reciprocal tariffs on nations earlier this month. The aftermath of the decision was such that global markets plummeted in distress over fears of a worldwide economic slowdown.

The move that was aimed at curbing trade imbalances and protecting domestic industries has done more harm than good, triggering retaliation from key trade partners, leading to fears of a full-blown trade war.

Although the US has given a 90-day relaxation, temporarily deferring tariff hikes for many countries, including India, . However, the horizon still appears clouded due to the uncertainty that lies ahead. During this period, India will bear a reciprocal tariff of 10%.

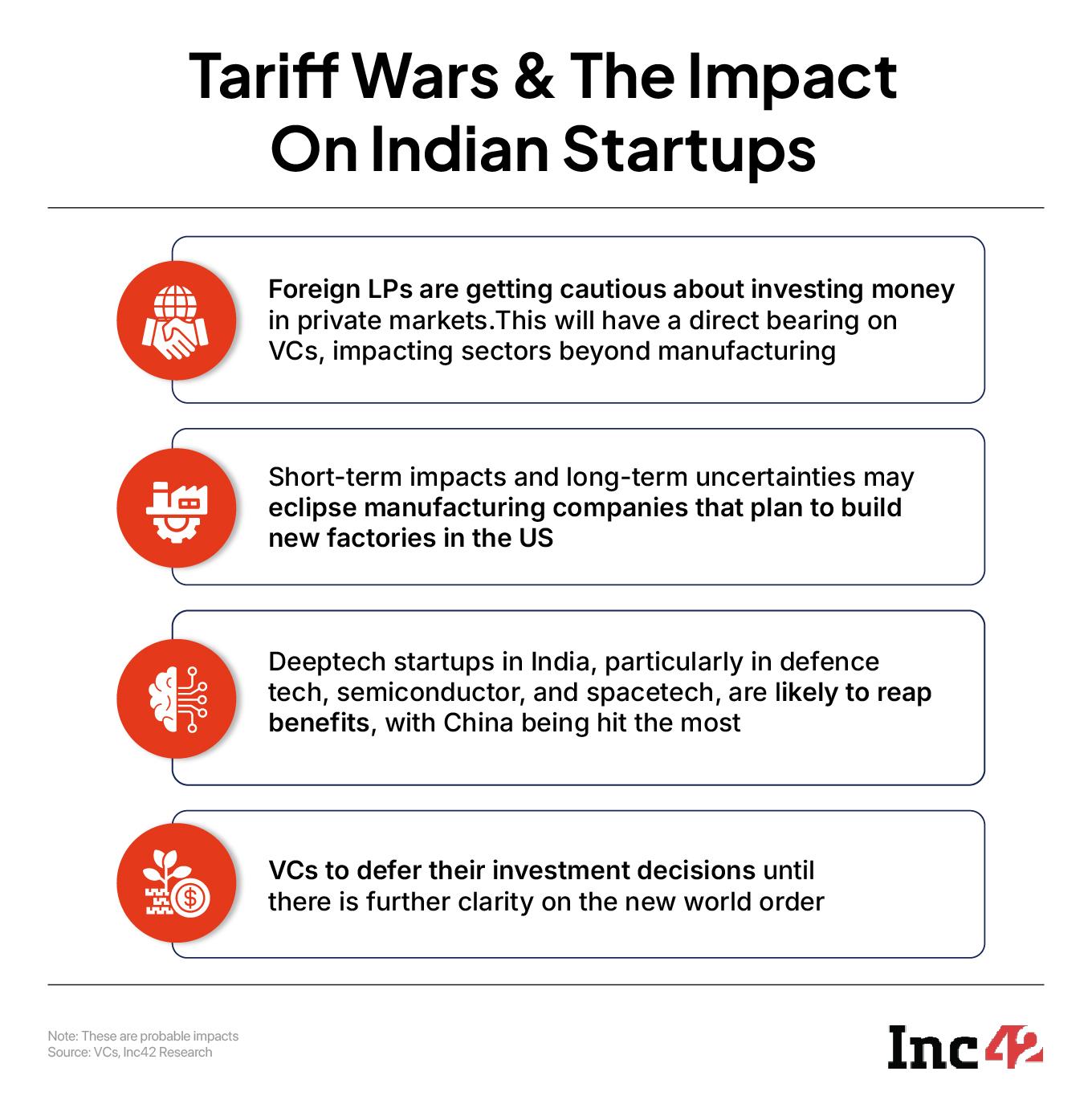

While venture capitalists (VCs) are keeping a close eye on the developments around tariffs, they are going to exercise caution for at least two quarters, and it is anybody’s guess what happens when VCs are cautious. Nevertheless, the ripples of this will be felt across the Indian startup ecosystem.

Speaking with Inc42, many investors confirmed that while they are watchful, they plan to tweak their investment strategies in tandem with the tariff war

Meanwhile, foreign limited partners (LPs), including HNIs and family offices, are expected to sit tight, holding their funds, for at least the next six months. on tariffs, as LPs shy away from the private markets.

A recent analysis by PitchBook, a capital markets research firm, suggests that the recent tariff announcements have significantly impacted VC-backed startups’ IPO plans in the US.

Amid the equity market sell-off, many VC investors want their IPO-bound portfolio companies in the US to stay put.

Back home, startup investors are groping in the dark to understand the impact of the US’ tariff decision on the country, while many see a glimmer of hope in manufacturing.

But, let’s not celebrate just yet because we may as well be looking at an impending crisis in the short term, similar to the one endured during the Covid-19 pandemic. Meanwhile, some also anticipate long-term blues for the global supply chain for certain goods.

All of these points to but one thing — an impending funding crisis. Even Paytm’s Vijay Shekhar Sharma recently warned that the tariffs could create a challenging business environment, potentially limiting startup growth and causing a short-term dip in funding.

However, according to Sharma, Trump’s tariff gambit may not have any material impact on Indian startups focussed on the domestic market.

Naturally, the next question arises — How might this affect startups that rely on the US market for exports, and to what extent could it dampen private market investments in the country?

But before we get into answering all of this, let’s hit rewind on Trump’s tariff gambit.

What Happened On “Liberation Day”?On April 2 — dubbed “The Liberation Day” by Trump — the newly elected US president announced that the country would begin imposing reciprocal tariffs on imported goods. This, as per the US president, would match the import duties the US faces when exporting to other countries.

In a statement on April 2, the White House pointed out that while the US imposes a 2.5% tariff on imports of internal combustion engine vehicles, the EU charges 10% on the same from the US, India levies a steep 70%, and China imposes a 15% tariff.

Similarly, the US charges zero tariff to import network switches and routers, while India charges the US 10% for importing the same product. The US president has deemed this as “unfair” trade practices.

India, too, was slapped with a 26% tariff on its exports of goods to the US, along with tariffs being hiked for many other countries.

However, within days, the US government announced a pause on this tariff for most countries for 90 days, but China got no breather. As per a recent statement from the White House, China faces up to a 245% tariff on exports to the US.

India’s public market indices shot up following the announcement. Not to mention, companies in the manufacturing sectors, including electronics and computer goods companies, are looking to reap the benefits. Despite this, uncertainty looms large for India, especially over what might unfold after the 90-day window.

Why Are VCs Turning Cautious?Trump’s tariff war has several angles and impacts — the biggest of them is the financial markets, which took a huge tumble in the wake of the announcements and climbed back up, after Trump paused the reciprocal tariffs.

According to Arpit Agarwal, partner, Blume Ventures, financial markets are complex and dynamic, where a high volume of transactions takes place and long-term calculations are done before a deal takes shape or prices of shares are set.

Investors often use methods like discounted cash flow (DCF) to value investments over long periods, sometimes up to 20 years. These calculations usually don’t factor in unexpected developments like a sudden rise in tariffs, and this throws off many projections.

Investors may now start rethinking how to value their share prices, considering the impact of new tariffs on their companies for the next few years until Trump is in power.

Besides, Agarwal explained that some manufacturing companies may now move to the US, which would come up as a major cost for them and increase the timeline that VCs were earlier looking at to see returns.

Also, during such uncertainty, half-baked information or a rumour has the potential to shift the market dramatically. This is why LPs or investors may refrain from deciding for the near term and rather wait to see exactly how the tariff impositions pan out.

Meanwhile, each VC has a different perspective on the current scenario.

The ones backing consumer-focussed startups operating mainly in India have a different outlook compared to the VCs betting on global manufacturing companies.

Chinnu Senthilkumar, managing partner at Exfinity Ventures, which has many portfolio companies earning revenue outside India, said that the shift in global supply chains began during the Covid-19 pandemic and has sped up since Trump returned to power in the US.

“We’re in a wait-and-watch mode when it comes to tariffs. Our global clients are also holding off on major decisions, which is affecting purchase orders,” he said, adding that their LPs are also cautious and closely monitoring how companies are adapting to the situation.

Senthilkumar, however, believes that though there are difficulties in the near term, better opportunities are around the corner and India must grab them.

Shot In The Arm For India’s Deeptech?In fact, amid the tariff uncertainties and China taking the biggest hit, VCs see their sweet spot in sectors like defence tech, semiconductor, spacetech. However, for India to make the most of this opportunity, a seamless policy framework, led by the government, would play a key role.

Senthilkumar is also of the view that US investment in Indian startups will continue in a more calibrated manner, and deeptech VCs and companies, which are already seeing an increasing interest, are set to win in the long-term game.

With China facing higher tariffs, many Indian VCs see this as a chance for India’s deeptech manufacturing and exports to grow.

According to Speciale Invest’s managing partner Vishesh Rajaram, the VC firm is planning to leverage the current situation to focus on advanced manufacturing, semiconductors, and defence tech.

“I don’t think many other VCs, who would want to invest in defence tech, but have already raised capital from LPs in certain geosensitive areas, have the scope to do it, but we will take that opportunity,” Rajaram said.

But, beyond everything, the focus that has been cast on deeptech in India in recent days will influence the flow of greater capital into this sector. “Alongside, we need to have a clear map of what needs to be done to influence that flow,” Ashwin Raguraman, partner at Bharat Innovation Fund, said.

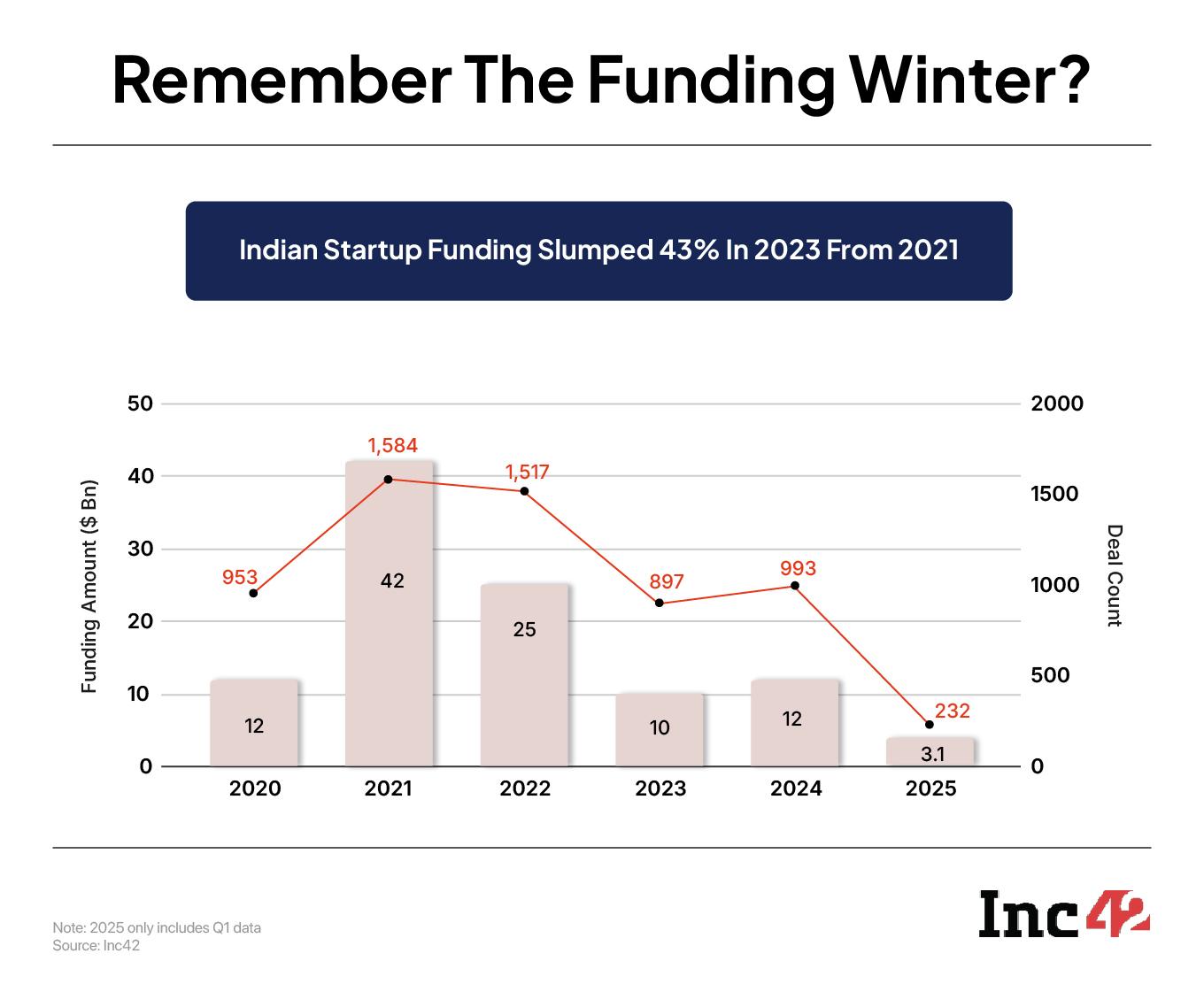

Are We Looking At Another Funding Winter?As uncertainties loom large due to the US president’s frantic actions of imposing tariffs, it is also time to address the elephant in the room — Are Indian startups staring at yet another funding winter?

While Raguraman pointed out that such measures often lead to poor or slow decision-making. This will likely prevail for a while.

But, Blume’s Agarwal continues to be in the dark and has refrained from jumping to any conclusions. This is because a high tariff imposition on China will indeed dent the global supply chain.

“This large machinery of global commerce begins in China and ends in the US and other parts of the world. In just two quarters, many equations will have changed forever,” Agarwal said.

Giving a glimpse of the past, Agarwal added that the Covid-19 pandemic triggered the chip shortage, and no one could have thought this would result in disrupting the operations of global automakers.

“A lot of chip manufacturing was directed towards mobile phones and personal computers during the pandemic period. This impacted the global auto industry, which took two years to recover. No one could have accurately predicted such second- or third-order effects of the pandemic, but it happened,” Agarwal said.

But, even though most VCs see India in a more advantageous position compared to China, Mexico, and Canada, investors in funds and LPs plan to stay cautious for now — unless Donald Trump makes a complete U-turn on his tariff war.

[Edited By Shishir Parasher]

The post appeared first on .

You may also like

Namsai, ideal centre for Buddhist Circuit in North-East: Arunachal Dy CM Chowna Mein

IPL 2025: Talk Was On How To Score Runs In These Conditions And Take The Game Deep, Says Gill

Incredible map shows the 7 main languages spoken in Spain

Lateral entry will be a necessity in future: TV Somanathan

Indore: In-Charge Mayor, MLA Inspect Road Projects